The rise of open banking has greatly affected the financial services sector for businesses in the UK and beyond. The increased facilitation of data sharing from the big corporations to third parties has allowed challenger banks, such as Monzo, Starling and Revolut, to thrive and create products tailored to the needs of the typical consumer.

While still in its early stages, open banking has both increased the competition within the broader industry and manipulated the habits of a typical consumer based on trends and new information as a result of this greater funnel of data from the big banks.

With this in mind, we have found some interesting statistics related to open banking and mobile banking, that we have shared below:

1. 84% of financial services companies are investing in open banking products or services

One of the main objectives for any bank, from multinational corporations to SMEs, will be to prioritise consumer and client experiences. Open banking products and services allow them to do just that.

Whether it’s managing overdrafts, maximising savings accounts or anything else, the implementation of open banking products like money management tools and streamlined financial applications are catching the attention of the majority of financial services companies.

With so many companies in this sector choosing to actively pursue open banking in order to improve their operations, it cannot be denied that it is making an impact.

2. 64% of consumers are expected to be aware of how open banking could affect them by 2022

As mentioned above, open banking is still very much in its early stages of implementation. While typical consumers still need to fully understand how open banking works, as well as how it can assist them in making better financial decisions, it is yet to become common knowledge.

This is set to change in the coming years; however, as individuals and businesses alike become more immersed with open banking along with specific products and services. This, of course, is aided by the fact that big banks with a dominant market share are continually investing in open and mobile banking.

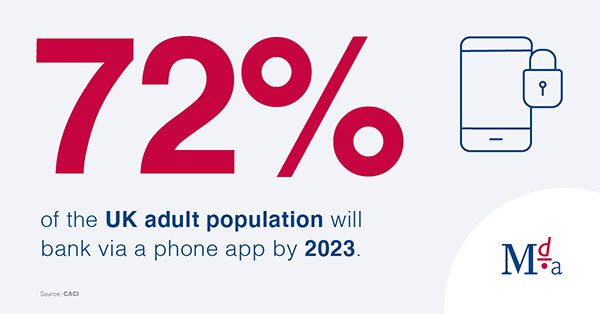

3. 72% of the UK adult population will bank via a phone app by 2023

You’d find it difficult in the modern age to discover a major bank in the UK that doesn’t offer some sort of digital application or online offering for their consumers. While the traditional attitudes of a bank steer towards visiting a local branch or sitting one-to-one with a consultant, the modern industry is heavily focused on digital solutions.

The majority of phone apps allow consumers to send and receive money, set up standing orders and schedule their finances at the touch of a button, meaning that it is no surprise that nearly 3/4 of adults in the UK will opt to use one within the next three years.

4. Mobile banking will become more popular than visiting a high street bank branch within two years

The need to visit a local high street bank branch has declined rapidly as technology has continued to dominate every corner of the industry. With the rise of open banking and greater innovation, it will become less common to seek out a direct consultation with an actual person representing a bank.

This is accompanied by the fact that there are now several banks that operate solely on a digital basis, meaning that they have no local branches for consumers to visit.

It is an incredibly exciting time for open banking, from both a business and consumer perspective. While it remains in the early stages, there appears to be a trend emerging from several reputable sources that open banking is to become the norm in the coming years.

For businesses in the banking sector, remaining ahead of the curve and utilising the benefits that open banking brings can prove to be extremely beneficial in the long run.

FOR BESPOKE BUSINESS BANKING TRAINING PROGRAMMES THAT DEVELOP THE SKILLS OF YOUR EMPLOYEES, CONTACT MDA TRAINING TODAY.

Sources: