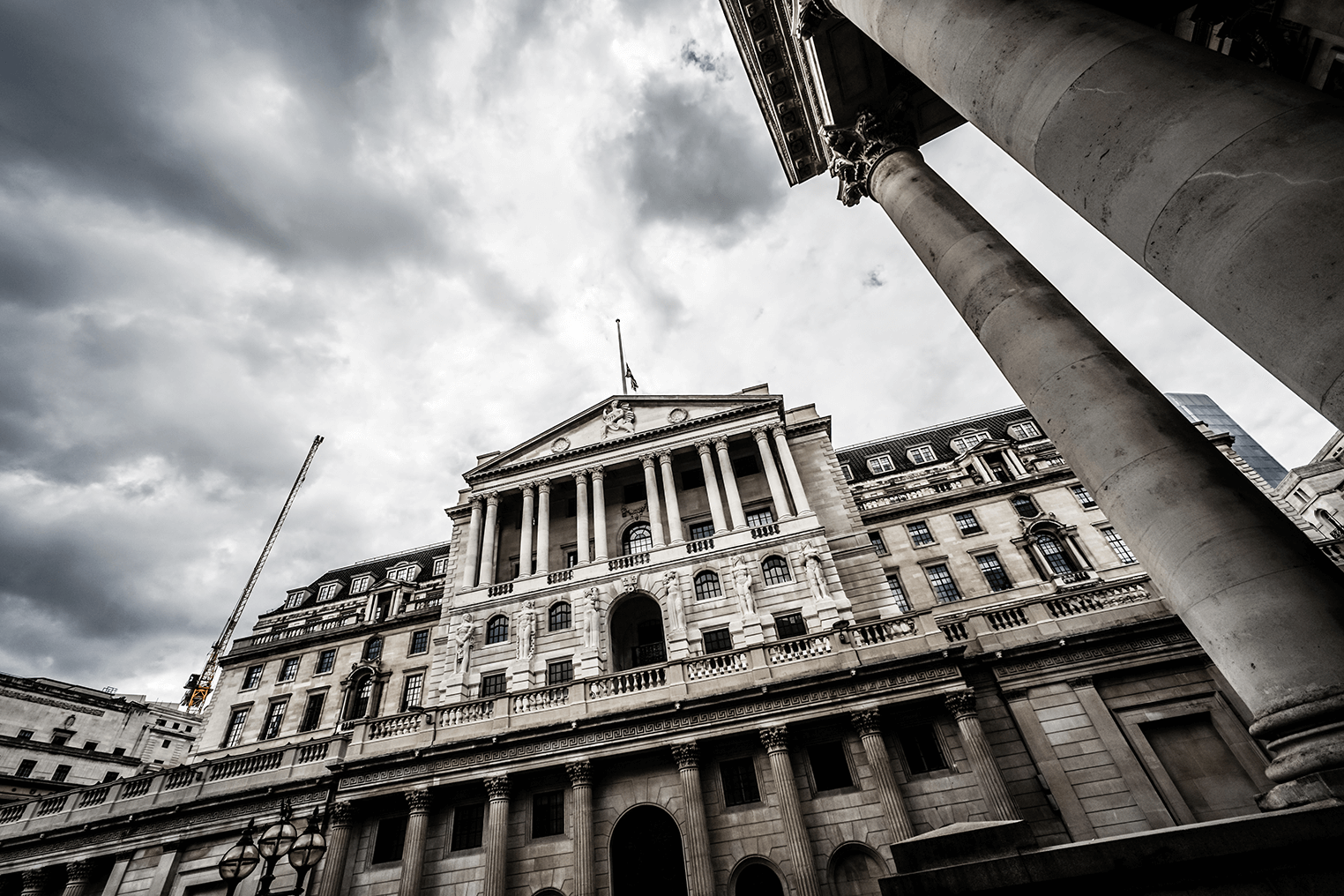

For more than several days we have been calling out for help for the SME community. All the focus so far has been on protecting our general population. This morning we have received our first dose of medicine from the Bank of England.

The Bank of England has reduced base rates to 0.25% and cut the special capital buffer that banks need to maintain. The special capital buffer helps to protect the bank shareholders and depositors should borrowers get into difficulty and not be able to repay. All of this is very good news; the high street banks have the arsenal to support SMEs.

We should not forget however that the high street banks have come through a very difficult decade since 2008/9. The have had to rebuild both their business and balance sheets. Part of that rebuilding process was to re-examine their lending behaviour. Prior to 2008 credit was cheap and readily available. We will not go over old ground again, but this approach cost the banks dear.

During the rebuilding process banks looked at their lending criteria and refocused on the key elements of business sustainability and affordability. In other words, does the borrower have a sustainable future and be able to generate sufficient cash to repay any debt. Sensible policies which have resulted in credit being less freely available and only the stronger business being able to borrow.

Now for the quandary. High st banks have refocused on business with sustainable business models and robust cash flows. Due to the continued impact of Coronavirus many SMEs face an uncertain future with little cash coming into the business in the short term. Instinctively, these are businesses that the High St find it difficult to support because of the uncertainty surrounding future cash flows. But if SMEs do not receive bank support, they will have no future at all.

It will require a bit of a leap of faith. The High St banks need to look beyond the current epidemic. When the outbreak is under control will the economy return to something looking more like normal? Will the SMEs once again be able to generate cash and repay the extended facilities? There are no certainties as we are all looking into to the future and wondering what it will hold. Without the SME community our economy and employment levels will struggle. In this current crisis the banks are part of the solution. We need to hope that the banks can modify their lending criteria and step forward and deliver the second dose of medicine to the SME community.