It is becoming a bit like Ground Hog day. Every day we read about the pace of spread of Coronavirus and the number of new cases compared to the previous day. This has been going on for some time now. The only change has been the focus away from China and onto other parts of the world.

The daily updates have increased levels of fear and concern amongst the 5.9m SMEs and 4.9m self-employed. Much of the advice so far has been built around self-quarantine measures and cancelling large gatherings of the population. Although these measures are being applied inconsistently.

However, these measures do not address how we ensure that SMEs can survive this period of uncertainty and continue to trade. Nor how we protect the income stream of 5.9m self employed workers, who represent 15% of the working population.

It will only be a matter of weeks in some cases before some SMEs and self-employed begin to struggle from a cash flow point of view. There is a real challenge here to determine how to support robust businesses that find themselves in a challenging position and genuine weak businesses that are facing commercial challenges irrespective of Coronavirus.

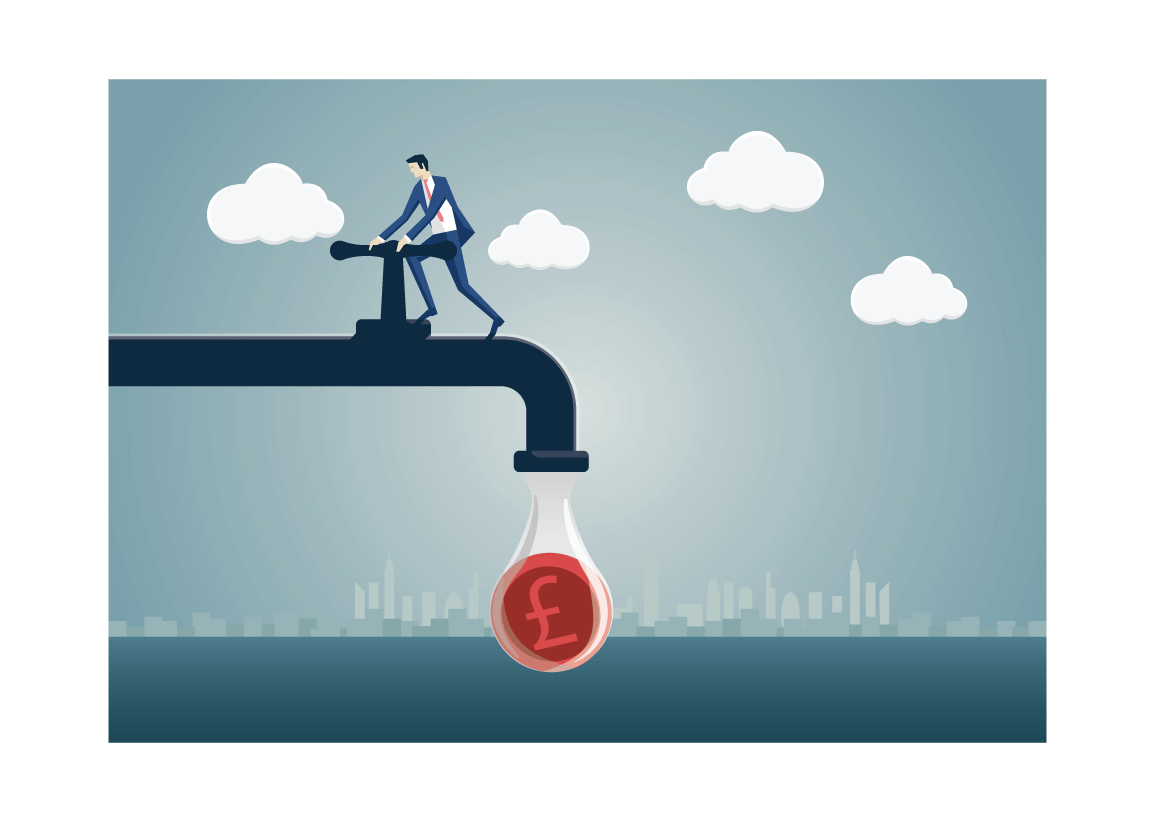

Cash is king and those affected will need access to cash flow to survive. Consider the alternative. If we cannot find a route to support both SMEs and self-employed, when this period is over, we may not have sufficient business resource to kick start the economy. In time, new businesses will spring up and evolve to fill the gap. But that could take the best part of two to three years.

We read varying reports of the length of time before the outbreak of Coronavirus in the UK and Europe peaks, anything from six to 12 months. Time will tell. It is clear the business does not necessarily have the cash resources to survive an extended, lean trading period. We need to identify, very quickly how we can funnel cash into the SME and self-employed community.

Options that may have to be considered

- Temporary deferral of VAT payments – many SMEs are due to pay over VAT at the end of March

- Temporary credit facilities – underwritten by the Bank of England

- Emergency benefit support to self-employed.

The solutions, if they exist, will not be easy to implement. There will be difficulty in identify genuine cases from either fraudulent claims or under-performing businesses seeking to extend their failing business model.

Nonetheless, if the situation continues to deteriorate the business community needs to hear about plans to protect business and not just how often we should wash our hands.